Find Out How

by Kate Sullivan

Hard

truth time, y'all: In a poll conducted by the National Endowment for

Financial Education, the nonprofit found that one in three partnered

Americans has lied to his or her significant other about their finances.

For most, this consisted of hiding receipts or keeping another bank

account, but 13 percent of those polled admitted to lying about the

amount of their income or debt level.

That's like Lifetime movie-level deception! The NEFE has dubbed this

phenomenon "financial infidelity." Since so many couples argue about

money, this is certainly a serious issue that should be discussed in

serious terms. But all indiscretions are not equal here. Tossing out a

receipt for a candy bar doesn't make me a cheater on par with that guy

who pretended to be a Rockefeller.

Hard

truth time, y'all: In a poll conducted by the National Endowment for

Financial Education, the nonprofit found that one in three partnered

Americans has lied to his or her significant other about their finances.

For most, this consisted of hiding receipts or keeping another bank

account, but 13 percent of those polled admitted to lying about the

amount of their income or debt level.

That's like Lifetime movie-level deception! The NEFE has dubbed this

phenomenon "financial infidelity." Since so many couples argue about

money, this is certainly a serious issue that should be discussed in

serious terms. But all indiscretions are not equal here. Tossing out a

receipt for a candy bar doesn't make me a cheater on par with that guy

who pretended to be a Rockefeller.

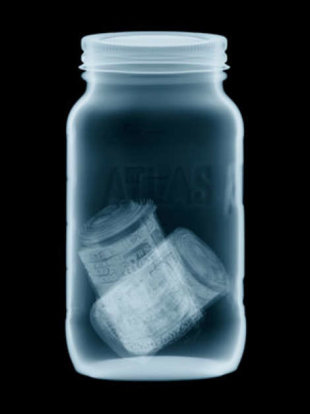

This was on my mind just this past weekend, when I visited a friend who just moved in with her boyfriend. They've been tacking their receipts onto a cork board by their kitchen door to keep track of their first month of shared expenses. Since they just moved in together, they've mostly been spending money on home decor items, groceries, and Home Depot runs-all purchases they both should be aware of. But I wonder what next month will look like. See, I know my girl. She's a big fan of the Dollar Tree and Christmas Tree Shops, and I have to wonder if every $3.99 purchase is going to make that wall. And really, should it?

Perhaps what they--and any couple--need to do is put an exact dollar restriction on the number of simple-pleasure purchases they make a month-iced coffee, magazines, a cell phone app, the odd scented candle-and make it a point to not exceed that set amount, all while still not sharing their every tedious financial move.

No comments:

Post a Comment