He's one of many self-made millionaires and billionaires who is intentionally leaving only small portions of their fortunes to their children. They're not doing it out of spite, but out of love. The famous and wealthy chef Nigella Lawson put it like this:

I am determined that my children should have no financial security. It ruins people not having to earn money.Roxanne Roberts investigated this trend for the Washington Post. She describes how one multimillionaire arranged his estate:

‘We probably struggled over this more than any other issue,” says a local self-made multimillionaire. The businessman and his wife, worth hundreds of millions, grew up modestly in middle-class families and wanted to create a financial plan that would take care of their children — but not spoil them — if the couple died suddenly.

“We were horrified by what might happen if they had control of a large amount of money at a young age,” he says. “The more we stared at that, the more we became uncomfortable.”

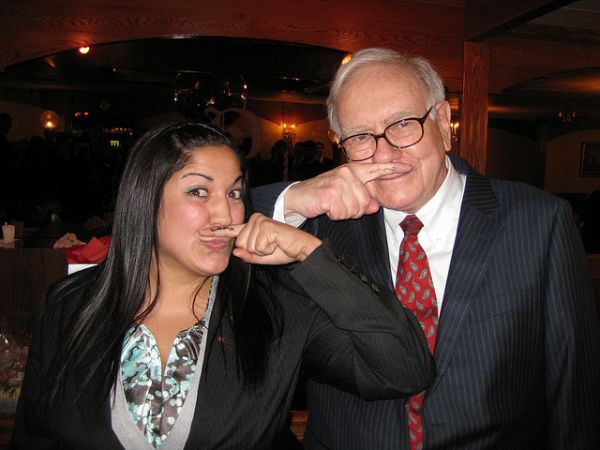

Inspired by Buffett’s example, they created trusts for each of their now college-age children. Each kid has $2.5 million controlled by trustees, who can release money only for education, health care, a home purchase or a business start-up. Any unspent money in the trust will continue to be invested and grow.

Those restrictions remain in place until each child reaches age 40; after that, the money is all theirs to do as they please. In their 20s and 30s, the funds are there to get them launched; by 40, their parents assume they will be mature enough to use the money wisely or save it as a safety net.

No comments:

Post a Comment